Warner Bros. Discovery linear networks continued to lose ground amid ongoing challenges, weighing on the fourth quarter.

Revenue eased 1% to $10 billion, shy of Wall Street forecasts. Net Some $1.9 billion charges including restructuring expense hit the bottom line as the company swung saw a $640 million loss for the last three months of 2024.

Streaming added 6.4 million subscribers pushing Max total global subs to 116.9 million.

Networks, WBD’s biggest segment, saw revenue dip 5% to $4.8 billion and profits down 13% to $1.9 billion. Ad revenue dropped 17%, driven by domestic networks audience declines of 28% and the continuing softness in the domestic linear advertising market. Distribution revenue eased 5%. Revenue from content jumped.

Media companies are transitioning to linear and WBD may be speeding up the process in a corporate restructuring to take effect later this year that many believe will ultimately lead to splitting off its cable networks, much like Comcast is planning to do.

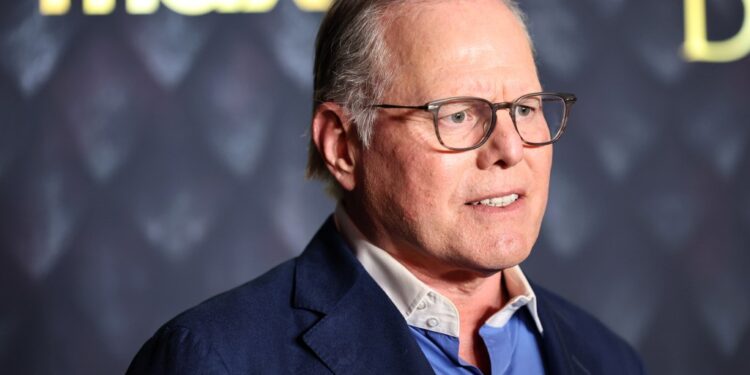

CEO David Zaslav will be presiding over a call with analyst at 8 am ET

Studio revenue rose 16% to $3.7 billion driven by TV, which jumped 64% on internal licensing agreements and higher initial telecast deliveries, which were impacted by the WGA and SAG-AFTRA strikes in the prior year.

Theatrical revenue decreased 9% on fewer releases.

The bugaboo of games saw revenue plunged 29%

DTC revenue rose 5% to $2.7 billion and the segment swung to a $409 million profit from a $55 million loss. Ad revenue rose 27%. Content revenue decreased 40% due to fewer third-party licensing deals.