Voters in a handful of communities in the south and southwest will weigh in on state funding for public schools in advisory referendums on the Nov. 5 ballot.

An initiative by two south suburban mayors and helped by the South Suburban Mayors and Managers Association started earlier this month to try to get the question before voters in several Southland communities.

Earlier this month, the association sent an email blast to managers and managers noting that in light of the high property tax bills and concerns expressed by homeowners throughout the south suburbs, they should pass and file the nonbinding questions.

In order to get a measure on the November ballot, communities needed to act by Monday, then submit paperwork to the Cook County clerk’s office by 5 p.m. Aug. 29.

The referendum asks voters to vote whether to urge the state to increase funding for schools in order to reduce the reliance on local property taxes.

A check of municipal websites and board agendas for more than 20 communities in the south and southwest suburbs showed just a handful of them took up the question at meetings and approved putting the issue to voters.

Burnham, Crestwood and Tinley Park put the question on the ballot, and officials in South Chicago Heights were to vote at a meeting Monday night to do the same.

The mayors and managers group is a council of governments serving 45 south and southwest suburbs, and an Aug. 9 email from Kristi DeLaurentiis, executive director, asked municipal officials to consider the nonbinding referendum.

DeLaurentiis said the initiative came from Phoenix Mayor Terry Wells and Burnham Mayor Robert Polk. Messages left with the mayors were not immediately returned and it was not clear whether Phoenix had voted to approve the referendum.

In an analysis in late June, the Chicago Tribune and Daily Southtown reported historic property tax increases were in line for south suburban property owners, and an analysis from the Cook County treasurer’s office found median tax bills rising by 19.9% compared with last year, the largest jump in the last 29 years.

The report found more than 327,500 suburban homeowners who live south of North Avenue will see higher bills this year. About 107,000 south suburban homeowners will see lower bills.

In Park Forest, where the median bill is up by $2,567 to $7,152, Mayor Joseph Woods called the increases a “catastrophe” for homeowners and said the village is working to influence policy changes at the county and state levels while seeking out grant funding to avoid having to levy more taxes at the village level.

The median bill in Phoenix nearly doubled, from $900 to $1,744, according to the treasurer.

Countywide, property owners are paying $700 million more in taxes, a 4% increase compared to last year, just below the 4.1% rate of inflation. Bills were due Aug. 1.

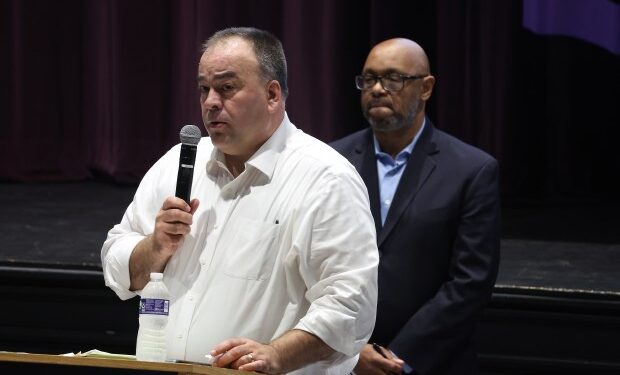

At a special Village Board meeting Thursday, Tinley Park trustees voted to put the question before voters.

The matter would also be discussed at Tuesday’s regular board meeting, but no further action is required.

Trustee William Brennan noted Illinois “is one of the highest-taxed states in the nation” and that the “south suburbs were hit hardest with our recent property tax bills.”

“I would like to absolutely see this in front of the state legislature,” he said.

Trustee Ken Shaw noted the pain of higher property tax bills and that “in some respects we’re on the verge of tax revolt.”

At a special meeting Thursday, Calumet City was scheduled to take up the matter.

However, Mayor Thaddeus Jones said officials had been told by attorneys that the city had passed the period to consider the question.

In Richton Park, the Village Board may vote on the advisory referendum at its meeting Monday, Mayor Rick Reinbold said.

“We have to send a message to Springfield that we have to figure out a better way to pay for public education,” he said Monday.

Reinbold said the advisory question had not been on the first draft of the board agenda that he saw, and said the challenge for communities was timing.

“Some communities require a first and second reading on some items, so it’s difficult,” he said.

Reinbold said some communities don’t have a second meeting at the end of August to accommodate vacations or board members trying to get their children ready and back to school.

“I don’t think that they don’t agree with the importance of the issue, it’s just the timing,” he said.

DeLaurentiis said it appears state funding for schools might be inching up to 34%, but that “it’s not enough to offset the cost of adequately educating our students.”

The fact that the referendum questions are advisory, and don’t force state legislators to act, isn’t necessarily a problem, she said.

“We are trying to elevate the discussion to ensure Illinois continues to make progress,” she said.

DeLaurentiis said, in the short term, there needs to be solutions to provide immediate help to people affected by the big jump in tax bills, such as “helping prevent people from losing their homes because of it.”

Reinbold said in less affluent communities, the bigger tax bill can be “catastrophic” for homeowners.

“A lot of households can’t afford an extra $300 or $400 a month to cover taxes,” he said.

Landlords in some communities might call it quits because the cost of property taxes on properties they rent has grown too burdensome, which could reduce the stock of affordable rental housing, Reinbold said.

Originally Published: