Today’s housing market has two competing realities: a cost crunch that shows no signs of stopping, and a stretch of rising inventories and slowing competition that could offer relief — for those who can afford it.

Homebuying difficulty fell by a half-point to 82.2 in May, according to data published Friday from the NBC News Home Buyer Index. That easing owes to factors including improved supply and slowing buyer activity.

But affordability remains a block for potential buyers. The Home Buyer Cost Index — a subcategory that includes home prices, mortgage and insurance costs — increased for the fourth month in a row and remains near its all-time high.

“High prices combined with high mortgage rates means housing is incredibly unaffordable for those who have to finance their home purchase,” said Daryl Fairweather, chief economist at Redfin.

The median list price of an average home increased in 70% of U.S. counties from May 2023 to May 2024, with a median increase of $22,000.

The median list price was roughly $444,000, over $75,000 more than a median income household could afford as of May, according to an NBC News analysis of Redfin data.

More on the housing market

There are some signs of improving conditions.

Competition is declining nationwide, as the Home Buyer Competition Index is at its lowest point in more than a year and has declined in eight of the past 10 months.

The decrease in competition is reflected in the time homes stay on the market, which has increased to near pre-pandemic levels. And the share of homes that sell within two weeks, 36%, is among the lowest it has been in the past five years.

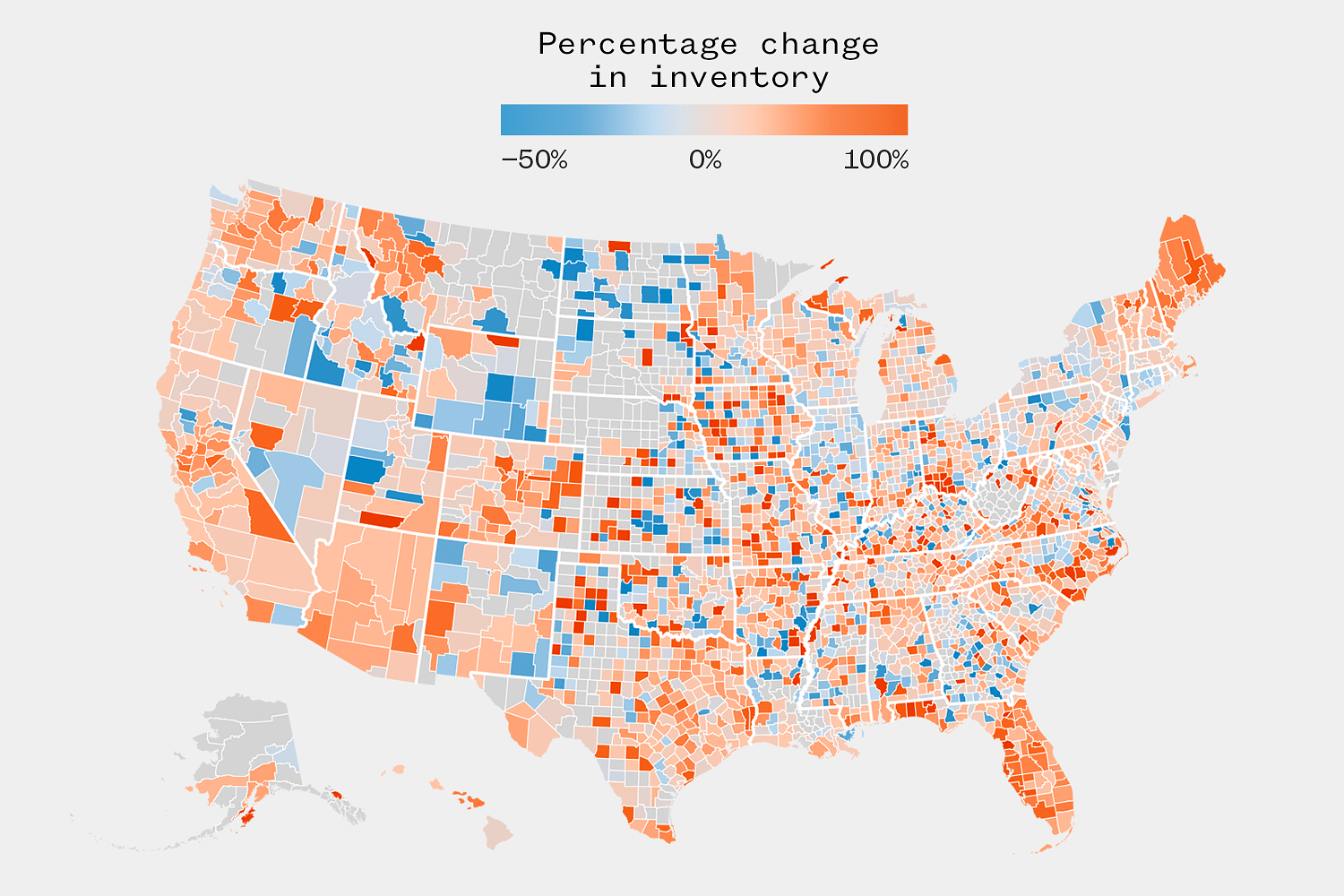

Nationwide, 1 million homes were on the market in May, a 16% increase over May 2023 — but still 32% less than before the pandemic in May 2019. Nearly 70% of counties measured saw inventory increases in the last year, and seven of the 10 counties with largest inventory gains were in Florida.