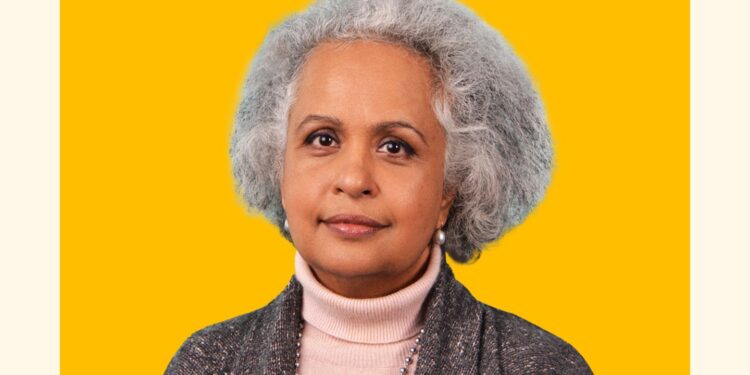

Good morning. HSBC Holdings Plc, in business for 159 years, is making history in its C-suite as it embarks on a company reorganization. Pam Kaur was promoted to CFO—the first woman in the role, the bank announced on Tuesday. She will begin her tenure as chief financial officer and an executive director of the board of directors on Jan. 1.

Kaur joined HSBC in April 2013 and went on to hold several leadership roles, most recently, chief risk and compliance officer. She succeeds the former CFO, Georges Elhedery, who was promoted to CEO.

HSBC has also landed at the No. 12 spot on the 2024 Fortune 500 Europe list announced this morning. The London-based bank has 42 million customers in 62 countries, with Hong Kong and Britain being its biggest markets by some margin. Its growth focus is back in Asia—particularly mainland China, Singapore, India, and the UAE—and internationally mobile customers, who already represent a sixth of its total.

In fact, HSBC has also announced a reorganization of the bank into four business divisions with “clear lines of responsibility”: Hong Kong, U.K., corporate and institutional banking, and international wealth and premier banking. Its geographical setup is revised with “Eastern markets,” comprising Asia and the Middle East, and “Western markets,” grouping the U.K., Europe and the Americas.

Courtesy of HSBC Holdings Plc

It’s no wonder HSBC elevated Kaur to CFO as she’s a financial services executive with almost 40 years of international experience. She has worked in the U.K. and the U.S. for British, American, and German banks. Some former roles include global head of group audit for Deutsche Bank; CFO and COO of the restructuring and risk division of Royal Bank of Scotland Group plc; and chief compliance officer at Citigroup International.

Kaur will receive a base salary of about $1.04 million per year, and a fixed pay allowance of approximately $1.4 million per year. She will also get a pension allowance of $104,269.55 per year equal to 10% of her base salary.

Russell Reynolds Associates’ (RRA) Global CFO Turnover index found that in the first six months of 2024, of the 163 CFOs appointed globally, 44 were women. The number of women appointed as CFOs globally reached a five-year high. However, women remain underrepresented in the role, according to the firm.

Kaur’s LinkedIn bio states that she’s a “passionate supporter of diversity and inclusion and proud to be the executive sponsor for HSBC’s Global Ethnicity Inclusion program.” She also writes that she was born in India, graduated from the Punjab University with an MBA in finance, and lives in London with her husband.

Sir Mark Tucker, HSBC group chairman, said in a statement that Kaur is “highly respected and well known to the board and was the unanimous choice.”

There was a strong bench of internal and external candidates and Kaur was “the exceptional candidate,” Elhedery said in a statement.

Elhedery’s promotion to chief executive at HSBC was announced in July and he officially began the role on Sept. 2. Elhedery joined the company in 2005 becoming CFO in early 2023. Before that, he held positions such as co-CEO of global banking and markets, gaining operational and strategic experience, which experts say can lead to CFOs being tapped for the chief executive role at a company.

Elhedery noted that Kaur, as CFO, will become his strategic partner. “I look forward to partnering with her for the next stage of the bank’s growth and development,” he said in a statement.

Sheryl Estrada

[email protected]

The following sections of CFO Daily were curated by Greg McKenna

Leaderboard

Tom Egan was appointed CFO of Hometap, a fintech company that provides a loan alternative known as home equity investment. He succeeds Eugene Wong, who left the company in August, according to his LinkedIn. Egan arrives from rent-to-own company Divvy Homes, where he served as CFO and head of capital markets. He also spent over 10 years at Barclays, eventually becoming head of EMEA leveraged capital markets.

Bhavna Kamalia was promoted to CFO of Shiftkey, a healthcare software company, effective immediately. She succeeds Brian Scott, who left the company last August, according to his LinkedIn. Kamalia joined the company in 2021 and most recently served as EVP of finance and accounting. She began her career at Cars.com, where held roles of increasing responsibility during her eight-year tenure.

Correction, October 23, 2024: A previous version of this article incorrectly stated that the most recent CFO of Shiftkey was not Brian Scott.

Big deal

Around a quarter of all U.S. households live “paycheck to paycheck,” or spend 95% or more of their income on necessities, according to a new report from the Bank of America Institute. Understandably, lower-income households are more at risk.

Roughly 35% of households that bring in less than $50,000 per year fall under this description, up from 32% in 2019. That proportion falls only slowly as incomes rise, however, with the term applying to 20% of households who make over $150,000 a year. One reason, the report said, is that bigger homes come with more expensive mortgages, as well as higher insurance costs, property taxes, and utility bills.

The share of paycheck-to-paycheck households tends to rise with age, the report found, peaking with Gen X and the baby boomers. The South Atlantic states had the highest share of such households by census division, while the Mid-Atlantic (consisting of New York, New Jersey, and Pennsylvania) fared best.

Going deeper

“The Strengths and Weaknesses that Set Founders Apart” is a new article in the Harvard Business Review. Researchers from leadership advisory firm ghSmart analyzed more than 1,400 data points from assessments of 50 founder CEOs and 58 non-founder CEOs in private equity-backed companies. The study found founders are typically “spikier,” meaning their strengths and weaknesses are more pronounced, compared to their professional counterparts.

Overheard

“The necessity for those leaders to have worked in multiple markets is quite crucial to understand the cultural nuances of either the teams that they’re leading, the customers that they’re supporting, the supply network that they’re working with.”

— Sarah Lim, managing director of board and CEO services at consulting firm Korn Ferry, told Fortune in an interview that achieving meaningful scale for many European companies invariably means expanding their business beyond home. There’s a similar thread among the CEOs in the Fortune 500 Europe list: Many have spent significant chunks of their careers overseas before landing the top jobs.