The Federal Reserve cut interest rates by a quarter of a percentage point Wednesday, in line with market expectations, even as inflation has reaccelerated over the past two months.

Fed officials have been trying to find the right tempo for rate cuts since starting them in September with a sizable half-point reduction, and Wednesday’s cut — the third in a row — shows them pressing ahead with their strategy despite some underlying strength in labor and price data.

The Fed is now projecting two cuts for next year as opposed to four.

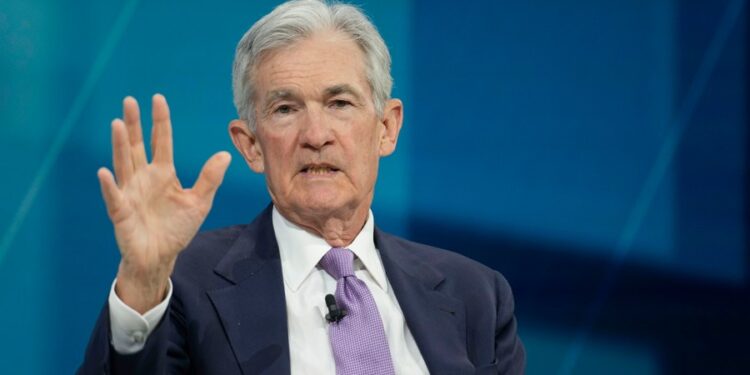

“As for additional cuts, we’re going to be looking for further progress on inflation as well as continued strength in the labor market,” Fed Chair Jerome Powell said Wednesday.

The economy added a robust 227,000 jobs in November after the labor market stalled out in October due to hurricanes and strikes. Prices in the consumer price index (CPI) have jumped to a 2.7 percent annual increase from 2.6 percent in October and 2.4 percent in September.

Removing the more volatile categories of energy and food, “core” consumer prices stayed even in November at a 3.3 percent annual increase after rising slightly in October. Wage growth has outpaced core price growth since July, with average hourly earnings posting a 4 percent annual increase in November.

Investors expressed concerns Wednesday that continued steady cuts from the Fed might not be in the cards if prices trend upwards.

“If inflation continues to stay above target in the new year, the markets may be too optimistic on how many cuts the Fed may deliver,” said Joe Gaffoglio, CEO of Mutual of America Capital Management, in a Wednesday commentary.

Cooling prices in the services sector, especially in housing, may be bolstering the Fed’s confidence on cuts. Inflation in housing prices has been running above the headline number since 2022, but moderated to a 4.1 percent annual increase in November even as prices increased overall.

Removing shelter from the CPI, inflation has been hovering around the Fed’s 2 percent target for the past year and a half.

“Housing services inflation actually is steadily coming down now, albeit at a slower pace than we might like, but it has come down now substantially,” Powell said.

Mortgage rates are undergirded by interbank lending rates, and the price of financing in general increases as interest rates go up.

“The Fed has spent the last 18 months fighting goods and services inflation that doesn’t exist, while making the housing affordability crisis worse,” wrote Kitty Richards, senior fellow at the Groundwork Collaborative think tank, in a commentary.

“In the process they have made everything more expensive for all of the American families who have car loans and student debt, and use credit cards to make ends meet during tough times.”

December economic projections from the Fed showed hotter performance expectations across the board. Central bankers hiked their inflation expectations in the personal consumption expenditures price index to 2.5 percent for 2025 from 2.1 percent in September. Core inflation was marked up to a 2.8 percent expectation for this year and to a 2.5 percent expectation for next year.

They expect 2024 gross domestic product to increase by 2.5 percent, up from the 2.0 percent expectation in September. They also see unemployment staying lower by 0.2 percentage points this year and by 0.1 percentage point next year.

Some economists suggested the Fed may have made a mistake in continuing with cuts instead of pausing.

“I don’t know why the Fed cut. Progress on inflation is at least temporarily stalled. Demand is strong. Financial conditions have loosened. And this move is inconsistent with the implicit reaction function they previously set out,” former Obama White House top economist Jason Furman said in a post on the social platform X.

Asked about the incoming Trump administration and whether some of its policies, such as tariffs, could be inflationary, Powell offered said monetary policy was now navigating somewhat in the dark.

“When the path is uncertain, you go a little bit slower. It’s not unlike driving on a foggy night or walking into a dark room full of furniture. You just slow down,” he said.

Updated at 2:52 p.m. EST