Roku easily outdid Wall Street analysts’ consensus forecast in the third quarter, delivering a 16% jump in revenue to $1.06 billion and narrowing its loss per share to 6 cents.

It was the first quarter the company exceeded $1 billion in revenue. Platform revenue, the dominant category that includes advertising, increased 16% over the year-ago quarter to hit $908 million. The company does not break out advertising as its own line item.

Analysts had expected a loss of 32 cents a share (compared with a loss of $2.33 in the year-ago period) and revenue of $1.02 billion.

In its quarterly letter to shareholders, the company signaled a change in its reporting protocol, with the number of active households no longer being reported on a regular basis. From time to time, Roku said it would disclose key milestones, such as reaching 100 million global households, a threshold it expects to reach in the next 12 to 18 months.

The shift, to take effect in the first quarter of 2025, will come as Netflix also switches things up and stops reporting subscriber numbers. Both companies say other metrics are better indicators of their financial condition. Roku said its key performance metrics starting in January will be streaming hours, platform revenue, adjusted EBITDA and free cash flow.

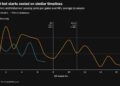

While Roku’s stock is far from the all-time highs it established in 2021 after a burst of momentum from Covid, it has been battling back toward break-even in 2024. It gained another 1% Wednesday to finish the regular trading day at $77.51.