State regulators have given two insurance companies the approval to raise rates for thousands of customers across California.

Beginning in late March, homeowners, condo owners and dwelling rental policyholders with Mercury General, the fifth-largest home insurer in the state, will see rates raised by 12% on average.

About 579,300 customers will be impacted.

Additionally, customers who have home insurance with Safeco, a subsidiary of the fourth-largest insurer Liberty Mutual, will see rates rise by an average of 7.2% in May. About 86,700 customers are affected.

Liberty Mutual’s rate hike won’t impact condo owners or renters since the company announced last year plans to exit the condo and renters’ insurance markets in 2026 as it seeks “a sustainable business path forward in California.”

Customers at either insurer can expect the rate hike to impact their individual premiums on their next renewal following the rate’s effective date.

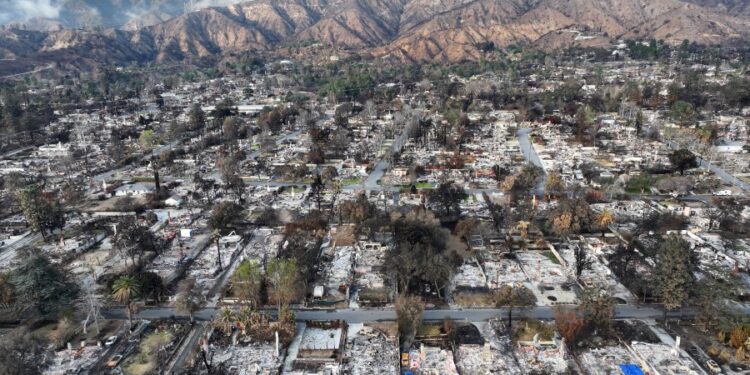

According to filings with the California Department of Insurance, both companies also submitted rate hike requests in June, months before the recent deadly and destructive wildfires in Southern California.

According to the Department of Insurance, insurers, including the FAIR Plan, had paid $6.9 billion in wildfire claims as of Feb. 5.

The FAIR Plan is California’s plan that provides insurance to homeowners who can’t get private coverage.