“Money changes everything.”

Pop legend Cyndi Lauper was just 30 years old when she sang those lyrics to the hit song of the same title from her 1983 album, “She’s So Unusual.”

“We swore each other everlasting love. She said, ‘Well yeah, I know.’ But when we did, there was one thing we weren’t really thinking of, and that’s money.”

Now, a new survey from LendingTree is highlighting how accurate she was.

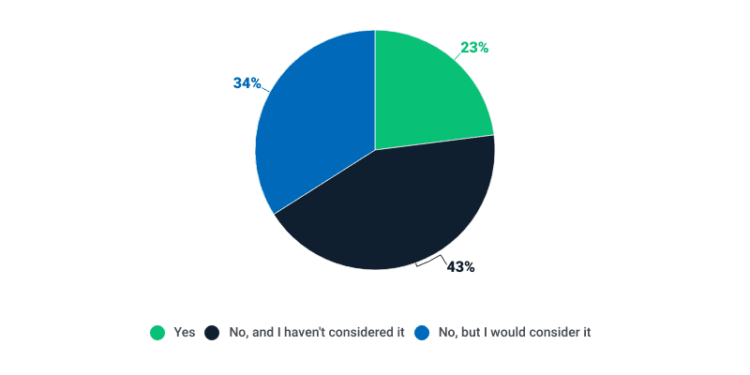

The survey reveals that nearly one in four people in exclusive relationships have ended a previous relationship due to financial incompatibility. Additionally, 34% of respondents indicated they would consider ending a relationship over financial differences in the future.

LendingTree surveyed more than 1,100 Americans who were in active relationships as of January of this year. They found that 83% of coupled Americans believe they are financially compatible with their partners, and 67% consider financial compatibility very important in a relationship.

Among those who feel financially incompatible, 38% blame their partner’s overspending, 34% cite poor financial management, and 30% point to insufficient savings.

Surprisingly, the survey also found that younger generations are more likely to experience financial conflicts. The survey found that about 27% of millennials and 25% of Gen Zers frequently argue about money with their partners.

“Generally, there isn’t one right answer to questions about how to handle money in relationships. There’s one big exception, though. Talking about money is nonnegotiable, period,” the study’s authors contend. “If your partner won’t talk about money, consider that a bright red flag. No relationship can thrive and benefit both partners in the long run if one partner refuses to talk about money.”