Tubi continued to gain traction in 2024, surpassing 97 million monthly active users and 10 billion streaming hours.

Fox Corp. paid $440 million in 2020 to acquire the free, ad-supported streaming outlet and has recently projected it will bring in $1 billion in full-year revenue, up from $150 million at the time of the acquisition. The outlet has become a welcome bright spot for the company, whose linear network assets are under ongoing pressure from pay-TV cord-cutting.

The MAU metric is not a universally agreed-upon one and is a holdover from the self-reporting early days of the internet. A Fox rep did not respond to Deadline’s request for clarification of how the company calculates an MAU. For some streaming businesses, the threshold is considered to be reached if an individual viewer spends just 15 seconds watching their service. Even if the bar is higher than that, Tubi’s 97 million MAU figure includes duplication across devices and within households.

Regardless of how users are quantified, viewership is undeniably increasing. Tubi has continued to climb Nielsen’s monthly Gauge chart of total viewing via TV sets, outpacing Max, Peacock and Paramount+ and running neck and neck with the Roku Channel as the No. 2 free outlet after YouTube.

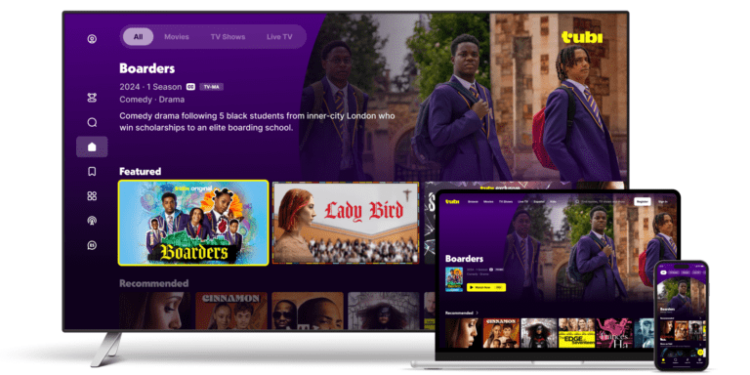

“Tubi’s momentum is growing as audiences increasingly value a premium entertainment experience that is also 100% free, fun and reflective of culture,” Tubi CEO Anjali Sud said in a press release. “Our strategy is simple yet powerful: put viewers first by offering unique stories from unique storytellers, a vast selection of content to choose from and a delightful experience across devices. We let our viewers guide us and obsess over their engagement, and we are seeing the results.”

The company’s report on 2024 also included some notable audience statistics. More than 34% of Tubi viewers are between the ages of 18-34, the company said, while more than half are Gen Z or Millennials and nearly half are multicultural. Fully 77% of viewers say they do not have cable, Tubi said, citing the November MRI Cord Evolution Study.

Unlike some streaming outlets like Paramount’s rival, Pluto TV, Tubi reports that 95% of its viewing is on demand rather than live.

Built a decade ago from library film and TV titles, Tubi has expanded its offering of originals, which are now watched by one in four viewers, according to the company. Young adult romance Sidelined: The QB and Me drew more viewers of any title in Tubi’s history in its first week last November and delivered the most new viewers for any Tubi title ever. In additional to the originals push, the streamer has also forged content partnerships with independent distributors and launched Stubios, a fan-driven studio aiming to harness the pot.