A shareholder has sued Warner Bros Discovery, the soon-to-be former home of the NBA, for violating securities law by misleading investors on the impact of losing its long-standing rights deal with the league.

Richard Collura filed the suit in New York federal court seeking class action status on behalf of shareholders who purchased WBD stock between February 23-August 7, 2024, which is when the media giant took a massive $9.1 billion write-down at its networks segment related in part, it said, to losing the NBA on TNT.

With linear television in decline, Paramount also took a large write-down in the same quarter.

Under its existing 2014 deal with the NBA, TNT paid an annual average fee of $1.2 billion. In 2024, the NBA entered advanced discussions with its various partners for a new round of media-rights deals that would last approximately a decade. WBD was unable to reach a new deal with the NBA before its exclusive negotiating window expired in April 2024, allowing the NBA to negotiate with other companies for its sports rights content, including, inter alia, NBC, which offered to pay an annual average fee of $2.5 billion, and Amazon, which offered to pay an annual average fee of $1.8 billion.

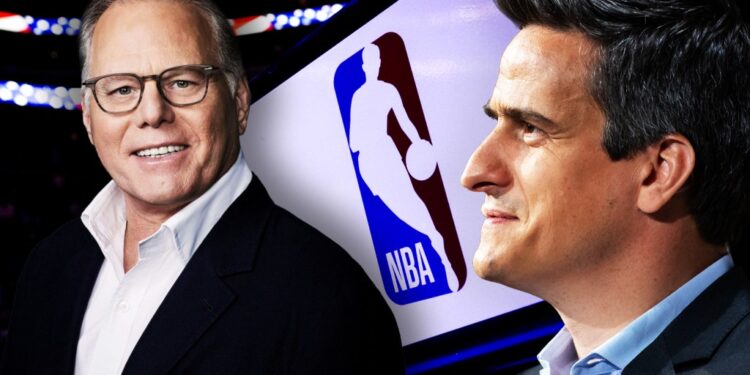

The suit claims defendants, which also include WBD’s CEO David Zaslav and CFO Gunnar Wiedenfels, “made materially false and misleading statements regarding the company’s business, operations, and prospects,” during the period specified and “failed to disclose that WBD’s sports rights negotiations with the NBA were causing, or were likely to cause, the company to significantly reevaluate its business and goodwill.”

Basically, it says the WBD defendants routinely “overstated WBD’s overall business and financial prospects” – like Zaslav stating on the first quarter call that WBD was “now on solid footing with a clear pathway to growth” and that the company is confident in its “ability to drive sustained operating momentum and enhanced shareholder value.”

WBD’s stock price fell by 69 cents, or about 6%, to close at $7.02 per share. It’s gained back ground since, closing Tuesday at $10.11. Bigger picture, the shares have fallen precipitously since Discovery acquired Warner Media.

“As a result of Defendants’ wrongful acts and omissions, and the precipitous decline in the market value of the Company’s securities, Plaintiff and other Class members have suffered significant losses and damages.”

There were warnings about the business and sports rights in the company’s 10-K and other filings, but the suit dismisses them as “generic” boilerplate that didn’t acknowledge the actual risk.

WBD had also sued the NBA for awarding its package to Amazon and in that lawsuit said the loss of the rights deal would be devastating. (The NBA and WBD subsequently reached a settlement that includes putting NBA games on Max in some international markets and a related deal with ESPN, which also has a package, to keep Inside the NBA on air.)

“During the Class Period, Defendants engaged in a plan, scheme, conspiracy and course of conduct, pursuant to which they knowingly or recklessly engaged in acts, transactions, practices and courses of business which operated as a fraud and deceit upon Plaintiff and the other members of the Class; made various untrue statements of material facts and omitted to state material facts … [to] artificially inflate and maintain the market price of WBD securities,” the suit said.