Legislation that would reform some aspects of Social Security is gaining steam in Congress.

The measure, dubbed the Social Security Fairness Act, would do away with tax rules that proponents say have led to unfair reductions in benefits for those who have worked in public service for much of their careers.

But the bill has also faced criticism over the projected price tag and has prompted questions of fairness from some experts who caution against completely eliminating a policy they say is designed to prevent certain workers from collecting more benefits than deserved.

Here are five things to know about the measure and its future in Congress.

Who would be affected?

The bill would repeal the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

While most jobs are covered by Social Security, many Americans have worked in state and local government jobs that fall outside of that coverage — and have been able to earn a pension instead.

For Americans who have worked in both types of jobs throughout their lives, payouts can get complicated when factoring in these particular Social Security tax rules.

Social Security provides relatively higher benefits to those who have lower earnings, Rich Johnson, head of the Urban Institute’s program on retirement policy, explained.

But some people, Johnson noted, appear to have low lifetime earnings because they worked for a short time in covered jobs, and spent a chunk of their career in a noncovered position.

“So, it’s not like they had limited earnings all the time, it’s just that they only worked a few years in covered employment,” Johnson said.

That can include those who worked in professions that allowed them to earn a pension — as teachers, firefighters, police officers and in state and local government jobs, for instance — for much of their career, but also worked at some point in a job where they paid Social Security taxes.

“They get Social Security coverage through those other jobs, but they didn’t work at those other jobs very long,” Johnson explained. “So, from Social Security’s point of view, they have low lifetime earnings, and so they get a high replacement rate. Social Security gives them more benefits relative to their earnings than they would have gotten had they spent their entire career in Social Security-covered employment.”

The aim behind WEP is to prevent such people from collecting both their pensions and relatively higher Social Security payouts.

The GPO also leads to reductions in benefits for the spouses that receive government pensions.

However, cases where the policies have led to over- or undercorrection for beneficiaries have helped fuel calls for reforms or complete overhaul of the measures.

In a joint statement earlier this month, Reps. Garret Graves (R-La.) and Abigail Spanberger (D-Va.), who have been leading the legislative effort, said “millions of retired public servants have waited more than 40 years for their elected officials to tackle this fundamental issue of fairness.”

“These retirees deserve the benefits they earned through their hard work — and they deserve to see the WEP and GPO eliminated.”

Questions of fairness

Multiple experts say fixes are needed for the rules, but they’re also cautioning against eliminating WEP and GPO.

“They were devised at a time when the government didn’t have kind of all the data it could get today, so they had to have these sort of crude rules to do it,” Andrew Biggs, a senior fellow at the American Enterprise Institute, said in an interview. “And so, on average, it’s about correct, meaning, on average, people are being treated more or less fairly. But it doesn’t necessarily work fairly in every case.”

“There have been some reforms that propose new data and new formula to try to get much closer to accurate every case,” he said. But, he added, “if you have some people who are being treated unfairly, just law of averages means you’ve got other people who are getting a better deal than they should be getting.”

“The solution to that is fix the formula,” he argued, not eliminate the rules entirely.

Research released by the Urban Institute in 2020 found that doing away with the WEP and GPO could lead to an increase in benefits for 4.5 percent of beneficiaries in 2025, and “the annual increase for those affected would average about $7,300 (in 2018 dollars).”

“Affected beneficiaries in the bottom fifth of the lifetime earnings quintile would receive an additional $3,600 annually; those in the top fifth of the lifetime earnings quintile would receive an additional $8,900 annually,” researchers also said in the report at the time.

Price tag

Scoring from the Congressional Budget Office from earlier this month estimated that the Social Security Fairness Act could cost upward of $190 billion over a decade — a figure that’s been cited by critics and budget hawks opposing the push.

Marc Goldwein, the senior vice president at the Committee for a Responsible Federal Budget, raised alarm over the projection in an interview, while also arguing the bipartisan bill currently gaining attention in Congress could advance insolvency of the program “and worsen its long term outlook.”

“It’s hard to think of a worse policy, dollar for dollar, than this,” he said, while dubbing the measure the “Social Security Unfairness Act.”

It’s also drawn criticism from some hard-line conservatives in Congress, including Rep. Chip Roy (R-Texas), who described the legislation as “irresponsible.”

House consideration

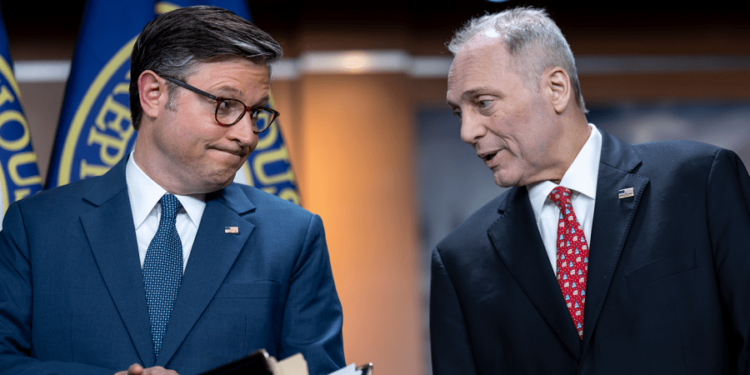

House GOP leadership has confirmed plans for a vote on the bill in November.

The move comes after a bipartisan group of lawmakers achieved the rare feat of gathering 218 signatures earlier this month for a procedural maneuver known as a discharge petition that will allow them to force consideration of the legislation.

Getting 218 signatures on a discharge petition is difficult because it’s a tool meant to bypass the leadership of the majority party in the House, so members of the majority party don’t always sign on, even if they’re supportive of the underlying bill. In this case, however, a Republican helped lead the push, and several dozen signed on.

The backers say the bill is a long time in coming, while pointing to support from more than 300 co-sponsors in the House.

Chances of passage

Despite strong support from both sides of the aisle in the House, there’s much uncertainty around the bill’s future, particularly as Congress faces a tight schedule to address several big-ticket items during the lame-duck period.

Experts are also pretty doubtful of the bill making it out of both chambers before the next Congress is ushered in this January.

“In the past, there’s been kind of gatekeepers to stop it, whether it’s leadership or Ways and Means,” Goldwein said. “They’ve done a variety of ways. The people that are serious have found ways to stop it.”